The number of confirmed cases of coronavirus is increasing every day. Business activities and international trade are restricted all around the world due to the rapid spread of the virus. Governments and central banks have a great responsibility to protect households and companies which are deeply affected by the current situation. Economic forecasts reflect the global recession in the world. So, will the coronavirus pandemic be strong enough to change the economic parameters in the long term?

What Awaits Us Economically During and After the Pandemic?

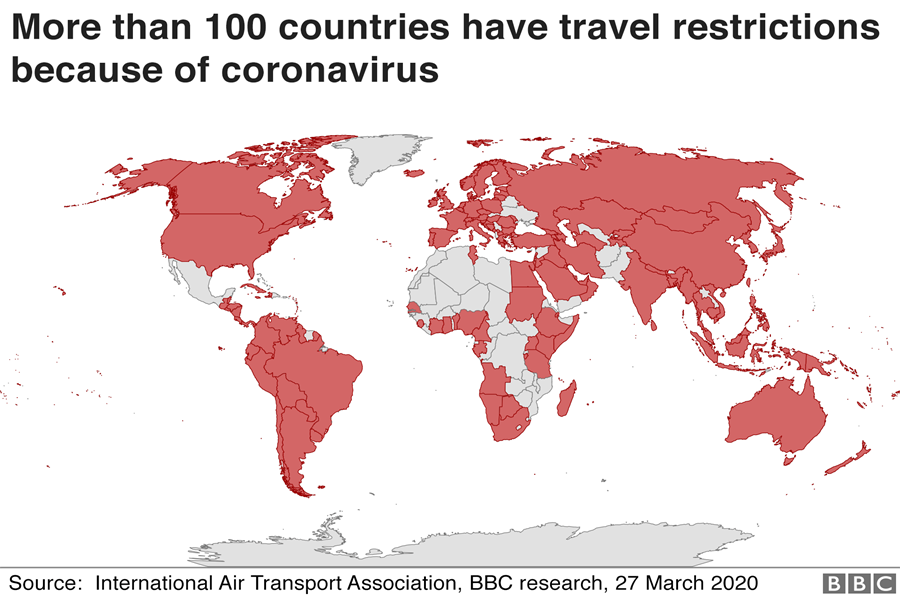

Tourism, travel, transportation are among the main industries that are heavily affected by this outbreak. The world’s largest airlines are facing a huge drop in revenue as a result of international travel bans. A similar decrease can be observed in the accommodation sector as well.

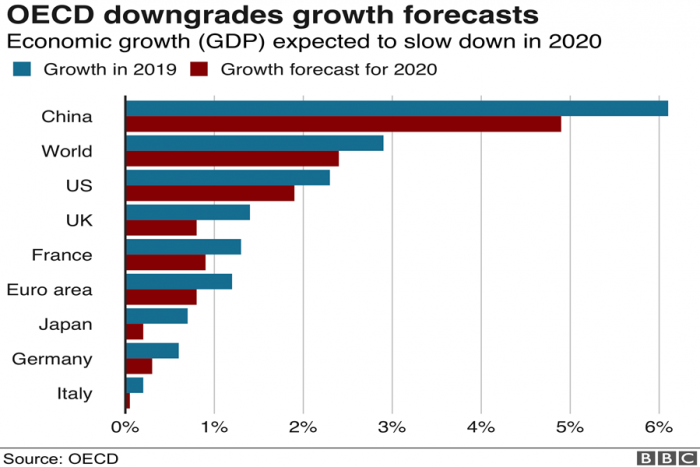

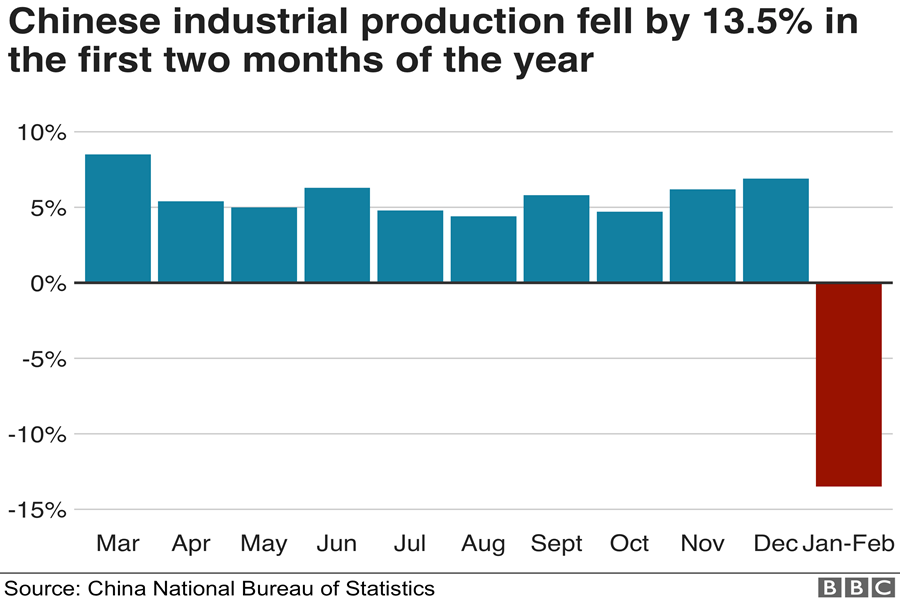

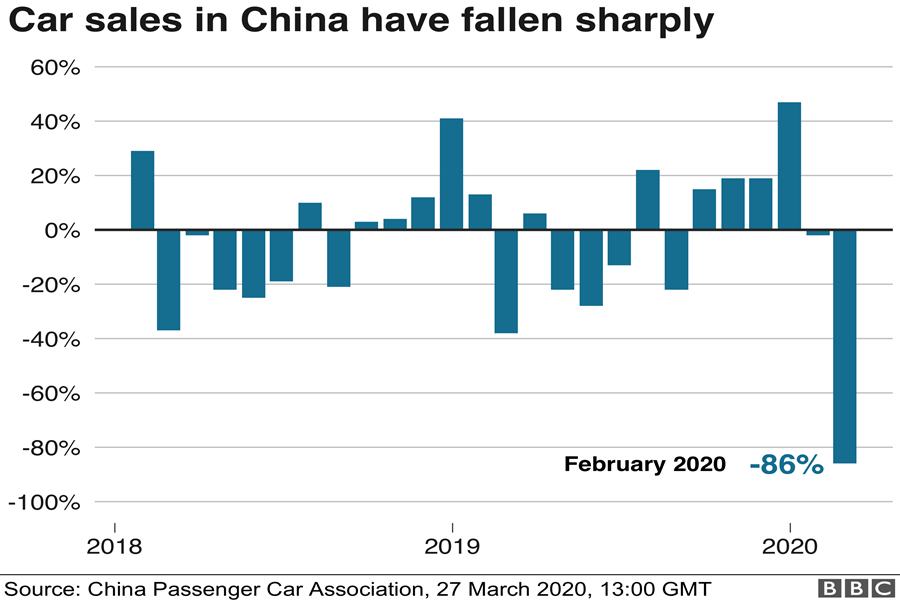

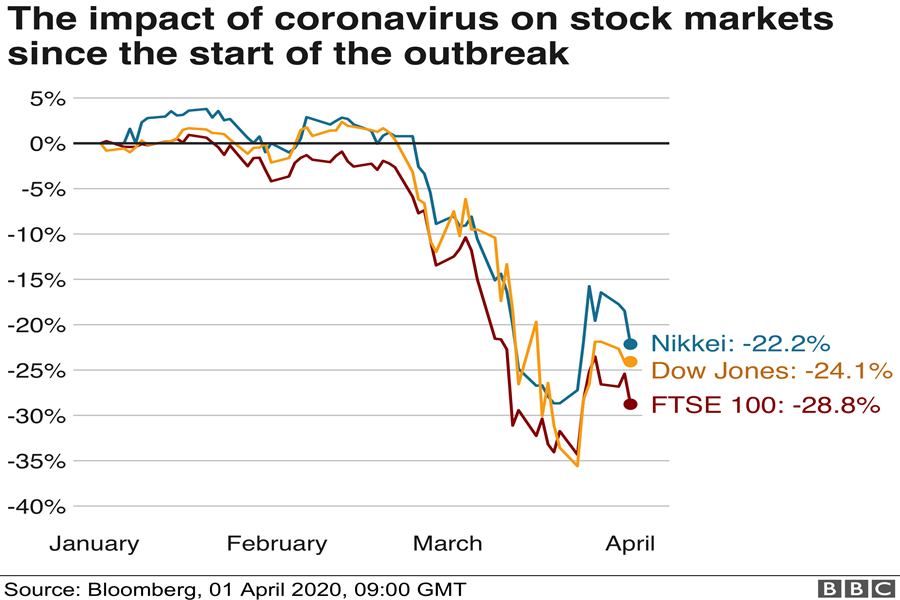

According to the global hotel chain Marriott, there is a 75% decrease worldwide. On the other hand, the automotive industry is at great risk. China, world’s largest automotive market, experienced 80% decline in February. OECD predicts that the world economy will grow at the slowest pace since 2009 due to the Covid-19 outbreak this year. According to estimates, only 2.4% growth is expected for 2020.

How Will We Overcome the Global Recession?

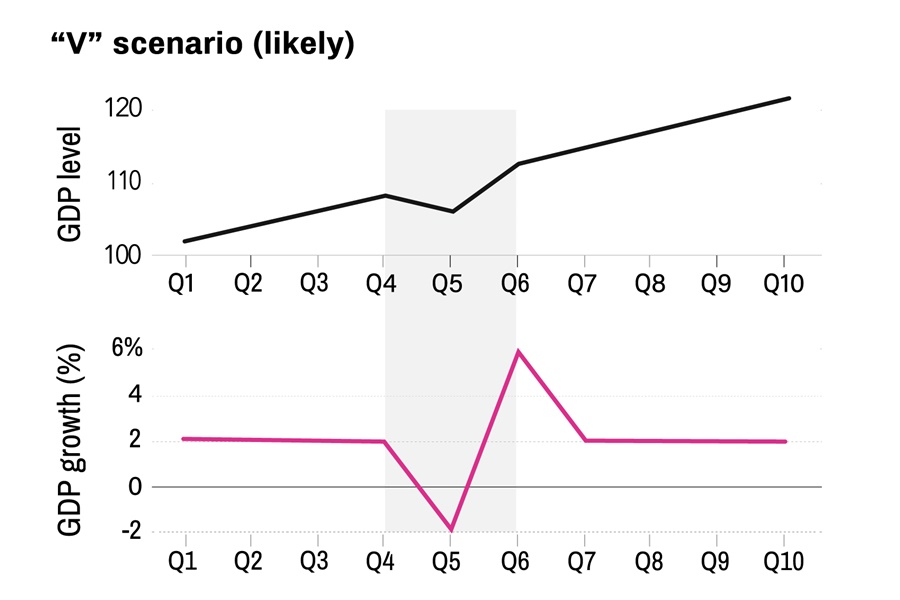

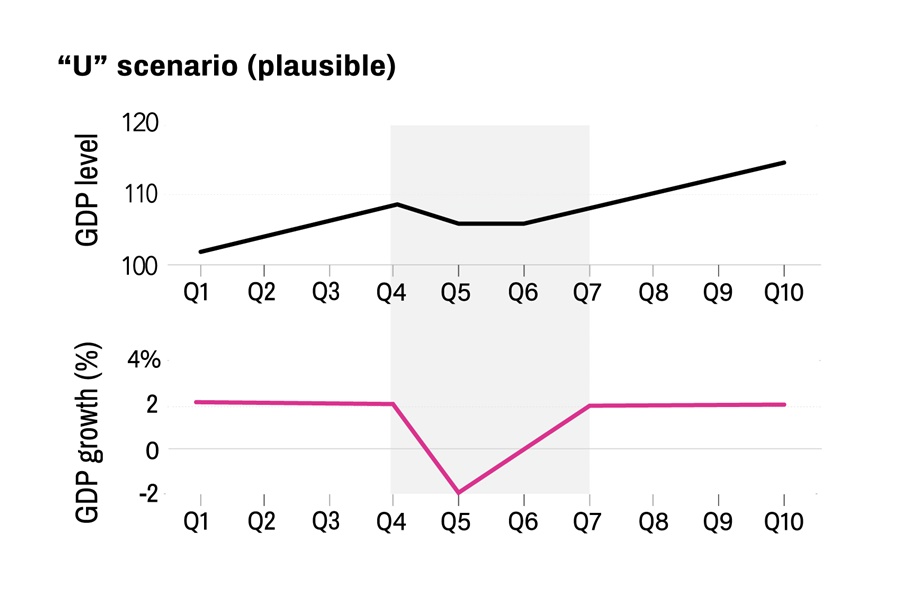

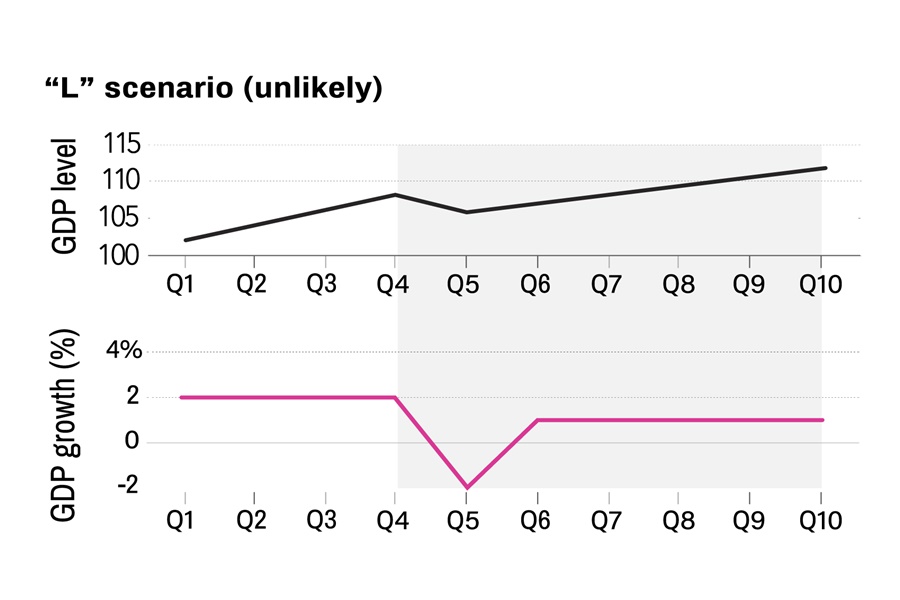

3 scenarios can be made to evaluate the future.

V Shaped Scenario

-V-shaped scenario predicts a quick recovery process. Despite the economic shock, growth is achieved. Annual growth rates absorb the effects of economic shock.

U Shaped Scenario

-U-shaped scenario is less optimistic than the previous scenario. In this scenario, the economic shock continues for a while and it takes a little longer to recover.

L Shaped Scenario

In the L-shaped scenario, Covid-19 has a permanent damage to the economic system. However, despite the pessimistic assumptions, experts say this scenario is unlikely to happen.

What about the Crisis in Turkey?

Automotive, retail and transportation sectors are negatively affected by Covid-19. Ford Otosan, Toyota and Hyundai stopped their production. Turkey stopped flights to 68 countries currently. As a result, it is estimated that the aviation sector will face around $100-120 million loss. Turkey’s trade partners are also affected by the virus which means that supply chains are deeply affected. Many hotel booking are canceled and hotel occupancy rates fell below 30% in some areas. Meeting areas such as cafes, cinemas, sports halls and shopping malls stopped their activities.

Due to social isolation measures, restrictions were imposed on individuals and businesses. Currently, curfews are imposed on individuals over 60 and under 20. Inequality in the workforce manifests itself in different ways. Although drivers, couriers, cleaning staff, retail workers and many others have to go out, the vast majority of corporate workers have the flexibility to work from home.

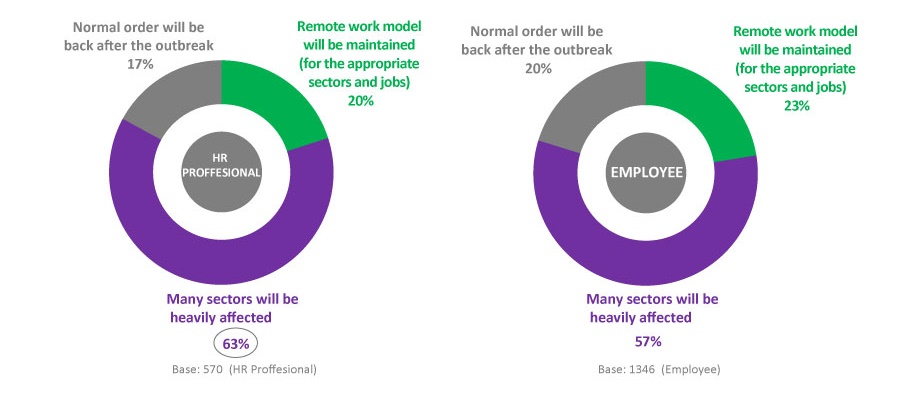

The survey conducted by Kariyer.net shows that, 57% of employees are constantly working from home, 28% are working from home on certain days and the remaining 15% has to go out to work. While one-fifth of HR officials and employees predict that the model of working from home will continue, the majority thinks that radical changes will occur in the sector after this pandemic.

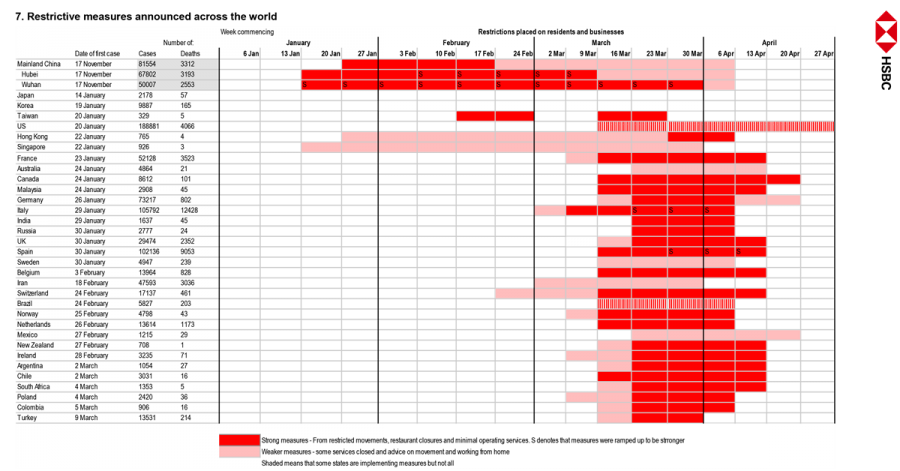

Effects of Restrictions on Economy

Although restrictive measures on businesses raise economic challenges, it would be an appropriate approach to examine China. In Wuhan province the restrictions started on 13 January, and were relaxed at the end of March 30. Today, business and social life have returned to its normal state in China. So, we should accept the fact that this just a temporary phase. On the other hand, as the concept of remote work becomes widespread, firms will be more open to integrating different working models into their structure.

At the beginning of 2020, Turkish economy actually gained momentum. According to the forecast of HSBC the coronavirus outbreak will decrease the annual GDP growth rate to -3.2%. After the pandemic, Turkish economy is expected to recover within a year. In 2021 the growth rate is expected to rise to 3.7%.

Stages of the Pandemic

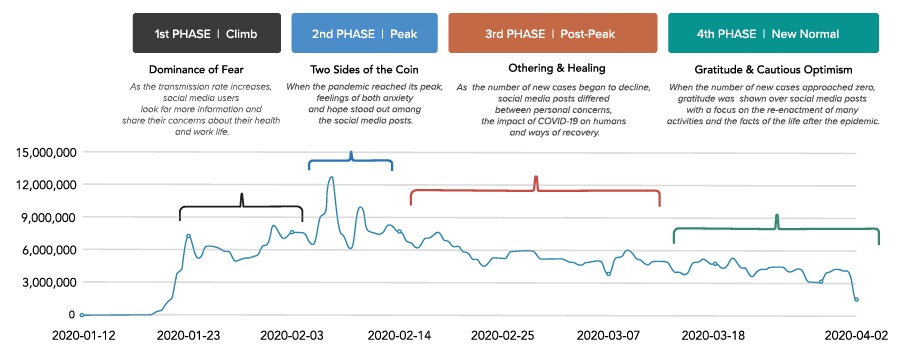

In order to successfully manage our current situation, it is important remind ourselves that this phase has a start and an end. Therefore, it will be useful to see different emotional states people go through during the pandemic period.

GolinMagic’s analysis states four different stages. Accordingly, the first stage in social communication marks a period in which fear and anxiety prevail. The second stage is the duality in the emotional state of the society when the number of cases reaches peaks: as the level of anxiety reaches the highest point, hope appears. In the third stage, the decrease in the number of cases emphasizes that people are entering a period of social and emotional recovery. The fourth and last stage is the period when the outbreak ends and the “new normal” is confronted.

Will the Pandemic have Lasting Impact?

The Covid-19 outbreak can affect the course of the global economy and policy in different ways. The crisis have revealed that consumption habits, accumulation, career plans and working models can radically change.

This accelerated the digital transformation. People enjoyed the remote work model. In fact, the research states that one out of every 2 employees wants to continue working from home. On other hand, vacation plans are postponed and saving plans are developed.

How nations handle the crisis surely has its political consequences. The virus reveals the institutional deficits which can trigger radical political changes. The different approach of political figures to the outbreak can shape results of the upcoming elections.

On the other hand, the crisis may further strengthen international cooperation or, on the contrary, extreme nationalism.

In the times of crises, society can rapidly adapt to new technologies. The SARS outbreak in 2003 led to the widespread adoption of online shopping among Chinese consumers. It is known that this SARS had an effective role in the success of Alibaba.

Likewise, this period can be the start of an innovation era in Turkey. As the tourism sector struggles to perform and Turkey creates more current deficit, Turkey will direct itself towards import-substituting industrialization. High exchange rates and cash injection from the central banks of Europe and USA, will provide resources to investors in Turkey.

Primitive Use of Artificial Intelligence: A Look from Past to Present

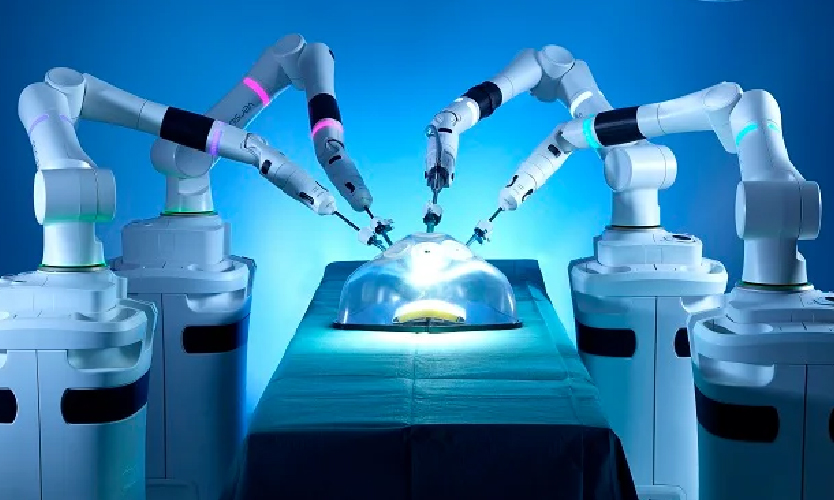

Primitive Use of Artificial Intelligence: A Look from Past to Present  The Future of Medical Design

The Future of Medical Design  A Night Full of Prizes: Celebrating 4 Wins at iF Design Awards 2023

A Night Full of Prizes: Celebrating 4 Wins at iF Design Awards 2023