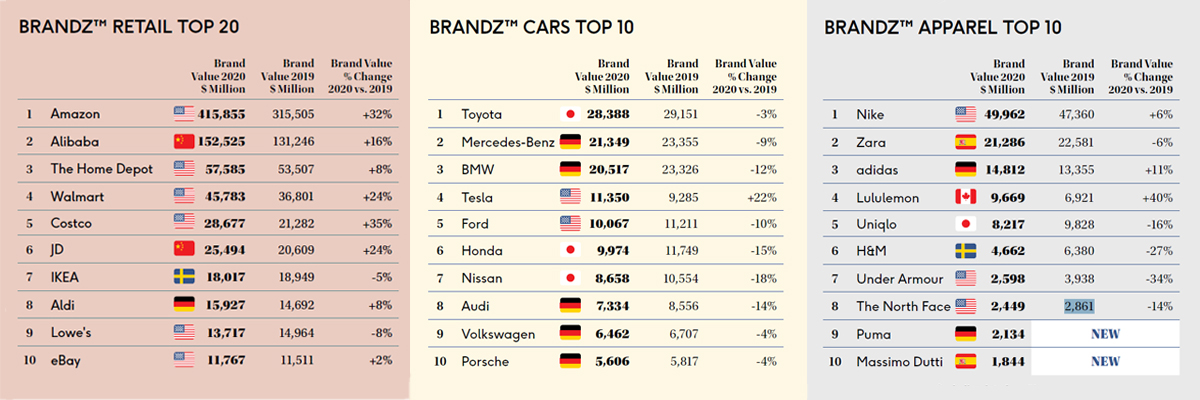

During this year’s pandemic, brands that have managed to adapt to the digital world have grown considerably. Companies that invested in strengthening their digital services during the quarantine have managed to attract more customers compared to their competitors. An great example of this phenomenon, is how brands that succesfully digitized during the pandemic, like Lululemon, Domino’s and Walmart have had online sales as much as brands which have been serving customers online for decades, like Amazon, eBay and Ikea.

Digitization Drives Category Growth

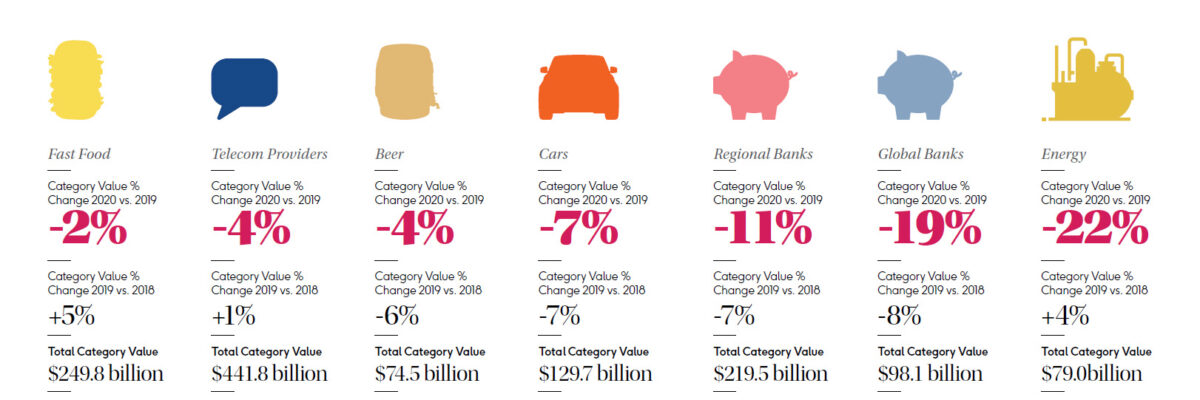

In 2020 only six of the global market categories increased in value; led by retail, up 21 percent this year, following a 25 percent increase last year, and technology, which rose 10 percent compared with a 4 percent increase last year.

For most categories—both those that increased and decreased in value—the gain or loss was modest and influenced by shopping behavior during the pandemic. In all categories, the economic repercussions of the new normal accentuated the impact of ongoing trends and dynamics.

Retail’s surge in value indicated how the category leaders have successfully transformed from exclusively bricks and mortar merchants to integrated online-offline, all-the-time operators. Both retail and technology categories reflected the impact of digitization and the ability of brands in those categories to both shape and meet the needs of people’s everyday lives. Similarly, e-commerce and delivery or pick-up options helped moderate the impact of home quarantining and the closure of physical stores, restaurants, bars, and sports and entertainment venues on the apparel, fast food, and beer categories.

The lack of physical retail hurt telecom providers as people purchased fewer mobile phones, which slowed revenue and subscriber growth for some network operators. The telecom category declined 4 percent. Whereas, the beverages category, responding to changing consumer attitudes about carbonated soft drinks, rose 4 percent in value, but still less from the 9 percent rise a year ago.

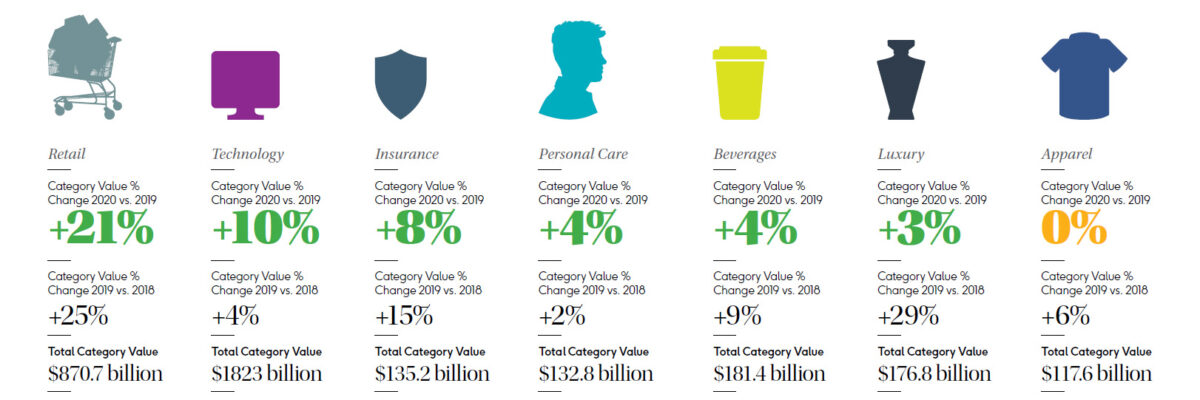

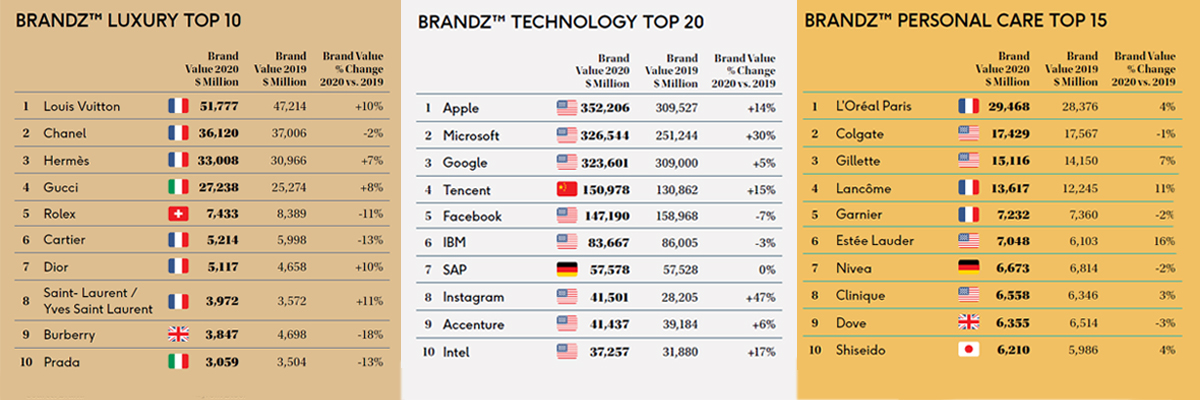

Brands most adept at digitization and closely aligned with consumer trends outperformed their categories. Although the apparel category remained unchanged in value, Lululemon’s finacial worth increased 40 percent. Domino’s Pizza value increased 12 percent, while the fast food category declined 2 percent. The performance of insurance brands based in Asia, such as Ping An and AIA outperformed the category, which rose 8 percent in value. Similarly, strenght in China helped Estée Lauder increase 15 percent in value and Lancôme increase 11 percent, surpassing the 4 percent rise of the personal care category.

Of the seven categories that declined in value, the four that declined by the greatest percentage—cars, regional banks, global banks, and energy— encountered fallout from geopolitics as well as the pandemic. Responding to regulatory pressure to reduce carbon emission, car brands had planned to introduce extensive ranges of electric vehicles. But reduced driving and economic uncertainty reduced interest in big purchases. Already struggling to balance stakeholder interests and produce a return on investment while evolving away from fossil fuels, energy brands were caught in a storm when demand evaporated because of Covid-19. In addition to this, global oversupply created an oil glut that drove the benchmark price of oil to below zero.

Covid-19 challenged banks, already struggling with an low interest rate environment and fin-tech competition. Important revenue streams slowed overnight, including cross-border mergers and acquisitions, IPOs, and corporate borrowing.

Apparel: Changing cultural values inspire newest fashions

Apparel brands which aligned with the pandemic values; such as dressing casually, trying to be healthier and environmentally responsible, increased most in value. Athleisure brands especially benefited from these trends, and fast fashion brands introduced initiatives to strengthen their sustainability credentials. Store closings impacted category value, which remained without gain or losses.

Transportation: Car makers accelerate rollout of electric models

This year carmakers were expected to begin delivering their promises regarding electric cars. Rather than having one electric vehicle in their product range, leading brands planned to offer an electric version for most of their models. The electric choices include both hybrids and electric plug-in vehicles that drive several hundred miles on a relatively fast charge.

Luxury Items: Progressive values shape traditional category

The influence of young consumers continued to shape the luxury category, even the very definition of luxury. Although attributes of luxury—design, materials, workmanship, exclusivity—remained essential, their expression evolved to meet the growing desire for products created with respect for people, the earth, and principles of sustainability

Personal Care: Cultural forces shape products and marketing

Increased expectations for personalized products in response to major cultural forces complicated the personal care category. Some other concerns such as health and wellness, sustainability, and inclusivity were also brought up. Particularly in the West, women rejected idealized notions of beauty in favor of expressions of individuality that varied from person to person.

Retail: Digitization prepares brands for pandemic

The digital transformation of retail brands lessened foreseen losses due to physical store closures during the Covid-19 pandemic. Retailers had not anticipated a global pandemic that would require closing most physical stores, any more than they had anticipated 25 years earlier that an online bookstore would become the world’s largest retailer. But this time retailers were better prepared.

Technology: Public concern pivots from privacy to pandemic

Weeks spent in quarantine—working, playing and communicating with friends online to maintain social distance—reminded people how instrumental technology has become to most aspects of everyday life. Of the 14 market categories, technology was second to retail in value growth, increasing 10 percent after a 4 percent increase a year ago.

Humanizing with IoT and data

In recent years we’ve noticed a clear trend of tech brands doing well. The fastest risers and brands that maintain their value best; like Haier are either moving beyond their hardware offers and tapping into the Internet of Things and apps industries or like Microsoft which have already built businesses and feel at ease with developing software. In some sectors cloud-based platforms like Google’s game streaming service Stadia now also pose a genuine (admittedly long-term rather than immediate) threat to physical hardware like gaming consoles.

Tech manufacturers are able to capture and utilize usage data, but they’re being held back by a perpetual fear of being percieved by users as misusing this resource. Yes, data comes with many perils and needs to be handled sensitively and transparently, but tech brands must not let their anxieties in handling data hold them back from enhancing their current devices with the help of data. You only have to look at how commonplace fitness and health apps are becoming to see how similar technological tools could enhance other devices as well. Many of us may not think much of an app that connects your vacuum and air conditioning your smartphone and reports on the status of your house, but would we still think the same if insurance companies started to offer rewards or lower premiums for digitally monitored houses?

Tech brands that overcome their initial hesistance and move outside their comfort zone have a chance in broadening their product range. Doing so will help them fight in the increasingly tough battle to stand out and maintain a price premium. In addition to aforementioned efforts, humanizing their offers and meeting deeper a layer of user needs, can provide a strong foundation for tech brands to appeal emotionally to their customers.

Primitive Use of Artificial Intelligence: A Look from Past to Present

Primitive Use of Artificial Intelligence: A Look from Past to Present  The Future of Medical Design

The Future of Medical Design  A Night Full of Prizes: Celebrating 4 Wins at iF Design Awards 2023

A Night Full of Prizes: Celebrating 4 Wins at iF Design Awards 2023